Introduction

Are you a financial advisor or life insurance agent striving to expand your client base in the retirement planning sector? If so, you’re in the right place. This comprehensive guide, inspired by Tyson Bailey’s insightful strategies, will revolutionize your approach to lead generation.

Here’s why you should keep reading:

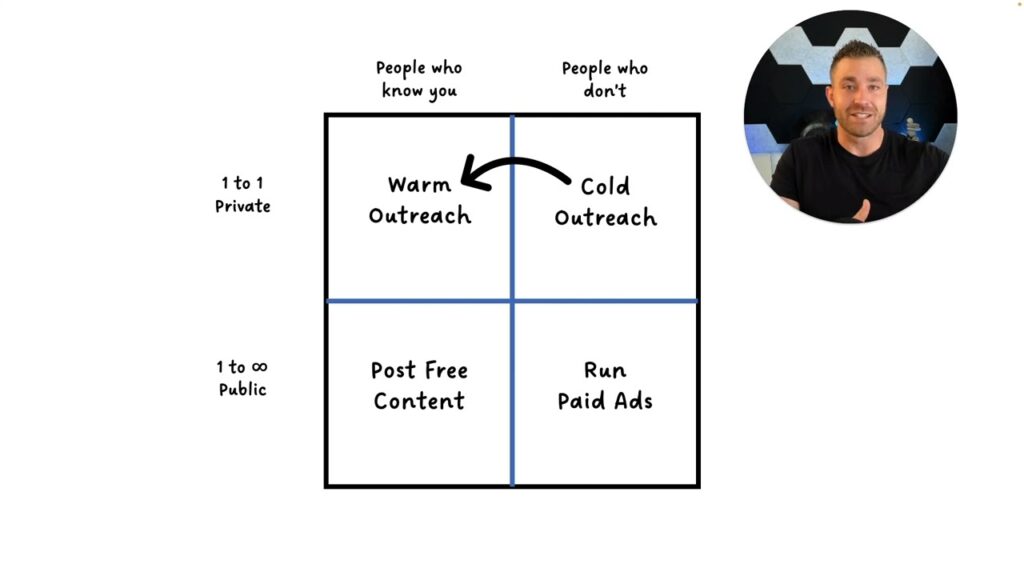

- Discover the Two Essential Lead Categories: Learn to differentiate and effectively target the two main groups of prospects.

- Master the Art of Content Strategy: Uncover the secrets of using content to attract a wider audience.

- Transition Techniques: Transform cold leads into warm, potential clients with ease.

- Leverage LinkedIn and Email: Utilize these platforms for organic relationship building and effective communication.

- Value-Driven Outreach: Understand how to offer value that converts prospects into clients.

- Follow-Up Tactics: Learn the importance of persistence and strategic follow-up.

- Educational Engagement: Find out how to educate your prospects about crucial financial products.

- Pipeline Consistency: Achieve a steady flow of prospects, reducing the need for constant chasing.

Understanding Your Lead Categories

Effective Content Strategy for Broad Reach

Why Free Content Matters:

- Reach: It allows you to reach a larger audience beyond your immediate network.

- Trust: Sharing knowledge and expertise helps build trust with potential clients.

- Engagement: Quality content encourages engagement, increasing your visibility and credibility.

Types of Content to Consider:

- Educational Articles: Write about retirement planning, financial tips, and industry insights.

- Videos: Share short, informative videos that address common questions or concerns.

- Infographics: Visual content can be more engaging and easier to understand.

- Webinars: Host online seminars to educate and interact with potential clients.

From Cold Outreach to Warm Connections

Transitioning prospects from cold leads to warm connections is a critical step in the sales process. This involves moving beyond initial contact to establishing a relationship where the prospect sees you as a trusted advisor.

Strategies for Warming Up Cold Leads:

- Personalized Communication: Tailor your messages to address the specific needs and interests of the prospect.

- Consistent Follow-Up: Regular, non-intrusive follow-ups keep you on the prospect’s radar.

- Provide Value: Share useful information, tips, or resources that can help the prospect, even before they become a client.

Building Relationships through LinkedIn and Email

LinkedIn Strategies:

- Profile Optimization: Ensure your LinkedIn profile clearly states your expertise and services.

- Engaging Content: Regularly post articles, insights, and updates relevant to retirement planning.

- Direct Outreach: Connect with potential clients through personalized messages, offering value without immediate expectations.

Email Communication:

- Personalized Emails: Tailor your emails to address the recipient’s specific interests or concerns.

- Value-Added Newsletters: Send regular newsletters with helpful information, market updates, and tips.

- Consistent Engagement: Maintain regular contact to keep prospects informed and engaged.

Offering Value to Convert Prospects

Offering value is a key strategy in converting prospects into paying clients. This involves providing something of worth that helps the prospect, thereby establishing your credibility and trustworthiness.

Ways to Offer Value:

- Free Resources: E-books, guides, or webinars that provide useful information.

- Expert Advice: Offering brief, personalized advice can demonstrate your expertise.

- Case Studies: Share success stories of how you’ve helped others with their retirement planning.

The Power of Follow-Up and Landing Pages

Effective follow-up strategies and the use of landing pages are crucial in converting prospects into clients. Tyson Bailey emphasizes the importance of persistence and providing easy access to more information.

Follow-Up Tactics:

- Timely Responses: Quickly responding to inquiries or comments shows you value the prospect’s interest.

- Regular Check-Ins: Periodic messages or emails to check in can keep the conversation going.

- Reminders: Gentle reminders about your services or resources can nudge prospects towards a decision.

Utilizing Landing Pages:

- Easy Access to Information: A well-designed landing page provides prospects with all the necessary information about your services in one place.

- Call to Action: Include clear calls to action (CTAs) that guide prospects on what to do next, like scheduling a consultation or downloading a resource.

- Tracking Engagement: Landing pages can help track prospect engagement and effectiveness of your marketing efforts.

Conclusion

- Expert Guidance: Leverage our industry knowledge and experience to accelerate your growth.

- Proven Strategies: Implement the strategies discussed in our video and more, which have been tested and proven effective.

- Community and Support: Join a community of like-minded professionals and gain access to ongoing support and resources.