Introduction

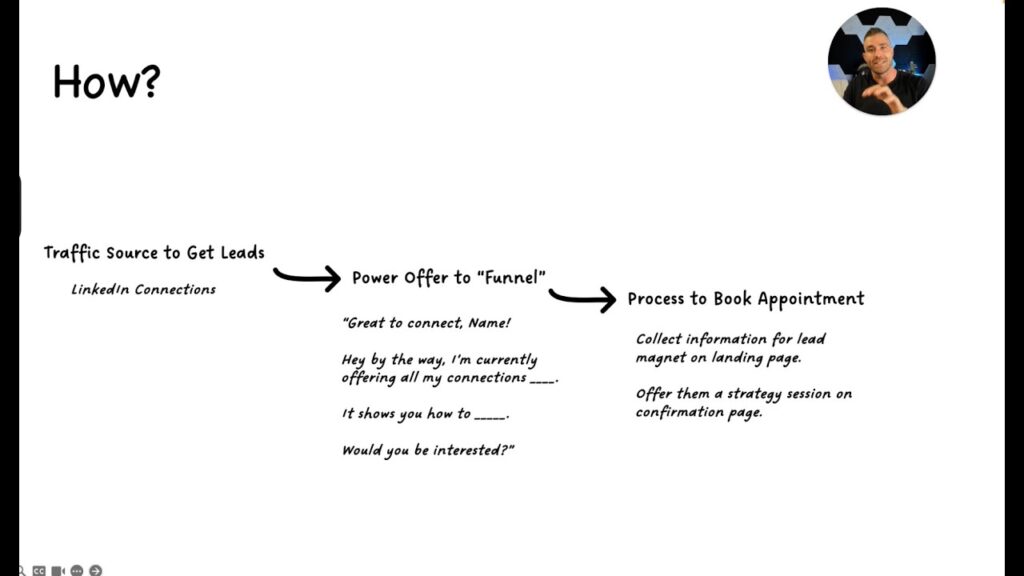

In the dynamic landscape of financial advising, mastering the art of cold messaging on social media is a game-changer for retirement planning professionals. This in-depth guide explores the innovative strategies for using social media, particularly LinkedIn, to expand your client base in retirement planning.

Here are compelling reasons to continue reading:

- Discover Conversational Selling: Learn the nuances of blending conversation with sales techniques to engage prospects.

- Effective Client Engagement Strategies: Uncover how to transition from casual conversations to actionable client commitments.

- The Power of Lead Magnets: Dive into the use of lead magnets for attracting and retaining the interest of potential clients.

- LinkedIn as a Client Acquisition Tool: Gain insights into leveraging LinkedIn for effective client outreach and relationship building.

- Utilizing Multiple Lead Magnets: Explore the strategic use of various lead magnets to enhance your marketing efforts.

Packed with actionable tips, real-life examples, and strategic advice, this guide is an essential read for retirement planning professionals aiming to leverage social media for business growth.

Conversational Selling

In retirement planning, engaging potential clients through Conversational Selling is a critical skill. This method is less about aggressive sales and more about building genuine connections.

Here’s how to excel in conversational selling:

- Prioritize Engaging Conversations: Initiate and sustain conversations that are more about listening to and understanding the needs of prospects, rather than directly selling your services.

- Integrate Selling with Conversation: Weave your selling points into these discussions subtly, guiding prospects on their journey with your expertise.

- Customize Your Communication: Tailor your conversations to address the unique concerns or interests of each prospect, making them feel understood and valued.

Transitioning Conversations to Client Action

Once you’ve engaged a prospect through conversational selling, the next crucial step is transitioning those conversations into actionable steps. This transition is where the potential client moves from being interested to being committed.

Here’s how to effectively guide this transition:

- Identify Client Needs: Listen attentively to understand the specific retirement planning needs of your prospect. This understanding allows you to tailor your advice and solutions effectively.

- Provide Actionable Solutions: Instead of vague suggestions, offer clear, actionable steps that prospects can take. This could be a personalized retirement plan review, a strategy session, or a specific financial product that suits their needs.

- Create a Sense of Urgency: Without being pushy, highlight the importance of timely decision-making in retirement planning. Use facts and figures to underscore the benefits of acting sooner rather than later.

By focusing on these strategies, you can smoothly guide prospects from casual conversations to decisive actions, significantly increasing your chances of gaining a new client.

Maximizing the Power of Lead Magnets

Lead magnets are an essential tool in attracting retirement planning clients. They offer valuable information in exchange for contact details, helping you build a list of potential clients.

Here’s how to maximize their effectiveness:

- Offer High-Value Content: Your lead magnet should provide substantial value, addressing common concerns or questions your target audience might have. This could be a guide, a checklist, or an e-book.

- Target Specific Client Needs: Tailor your lead magnets to address the specific needs of your target demographic. For instance, a checklist for maximizing retirement savings would appeal to individuals nearing retirement.

- Promote Your Lead Magnets: Utilize your social media platforms, especially LinkedIn, to promote your lead magnets. Engaging posts and targeted ads can increase their visibility and effectiveness.

Optimize Your Profile

- Professional Headshot and Banner: Your profile picture and banner should convey professionalism and trustworthiness.

- Compelling Summary: Write a narrative-style summary that tells your story, highlights your expertise in retirement planning, and speaks directly to your target audience’s needs.

- List Relevant Skills and Endorsements: Showcase your skills in financial planning and retirement advice, and seek endorsements from peers and clients.

Content and Engagement

- Share Valuable Content: Regularly post articles, insights, and tips related to retirement planning. This positions you as a thought leader in your field.

- Engage with Your Network: Actively comment on and share posts from your connections. Engagement helps in building relationships and increasing your visibility on the platform.

Use of Lead Magnets and Direct Messaging

- Promote Lead Magnets: Share your lead magnets in posts and in your profile, encouraging prospects to download them in exchange for their contact information.

- Personalized Outreach: Use LinkedIn’s messaging feature for personalized outreach. Tailor your messages to reflect the recipient’s profile, showing genuine interest in their financial well-being.

Harnessing Multiple Lead Magnets for Greater Impact

Utilizing a variety of lead magnets can significantly amplify your marketing efforts in retirement planning. Different types of lead magnets cater to diverse aspects of retirement planning, attracting a broader range of prospects.

Here’s how to effectively harness this strategy:

- Diverse Formats: Offer lead magnets in various formats such as e-books, webinars, checklists, and infographics. This variety caters to different preferences and learning styles.

- Topic Variety: Cover a range of topics relevant to retirement planning. From investment strategies to tax planning, provide resources that address various aspects of financial preparation for retirement.

- Segment Your Audience: Tailor your lead magnets to different segments of your audience based on their age, retirement goals, and financial status. This personalization makes your content more relevant and appealing.

Conclusion

In mastering the art of cold messaging on social media for retirement planning, the journey doesn’t end with just acquiring new techniques. It’s about continuously evolving and adapting to the changing landscape of financial advising. At Trained Advisor, we are committed to empowering retirement planning professionals like you with the tools, resources, and knowledge to not only attract more clients but also to build lasting, trust-based relationships with them.

Our approach, as highlighted in our insightful video, focuses on the practical application of conversational selling, effective client engagement strategies, and the innovative use of lead magnets and LinkedIn. We understand the unique challenges faced in the realm of retirement planning and offer tailored solutions to overcome them.

By partnering with Trained Advisor, you gain access to a wealth of resources and a community of like-minded professionals dedicated to excellence in retirement planning. Our strategies are designed to turn cold messaging into warm, fruitful client relationships, setting you apart in this competitive field.

We invite you to watch our video for a concise overview of these transformative strategies and to visit Trained Advisor for more in-depth resources and guidance. Together, let’s redefine the future of retirement planning.