Why This Guide is Essential for Your Marketing Success

In the complex and competitive world of life insurance marketing, standing out and converting prospects into clients is a challenge that requires strategic planning and innovative approaches.

This comprehensive guide is designed to provide life insurance agents and financial advisors with in-depth knowledge and actionable strategies to enhance their marketing campaigns.

Here’s why you should keep reading:

- Discover Focused Marketing Techniques: Learn how to concentrate on specific aspects of life insurance to attract and engage your target audience.

- Understand the Power of the “Light Bulb Moment”: Uncover the secrets to making prospects realize the true value of life insurance.

- Master Email Marketing: Get insights into crafting effective email sequences that lead to higher conversion rates.

- Address Client Pain Points Effectively: Learn how to approach potential clients by addressing their unique concerns and needs.

- Enhance Your Overall Marketing Strategy: By the end of this guide, you’ll have a clearer path to refining your marketing tactics and boosting conversions.

With a blend of expert advice, practical tips, and industry insights, this guide is an invaluable resource for anyone looking to excel in life insurance marketing.

Let’s dive into the first section to start transforming your marketing approach.

Focusing on Specific Aspects of Life Insurance

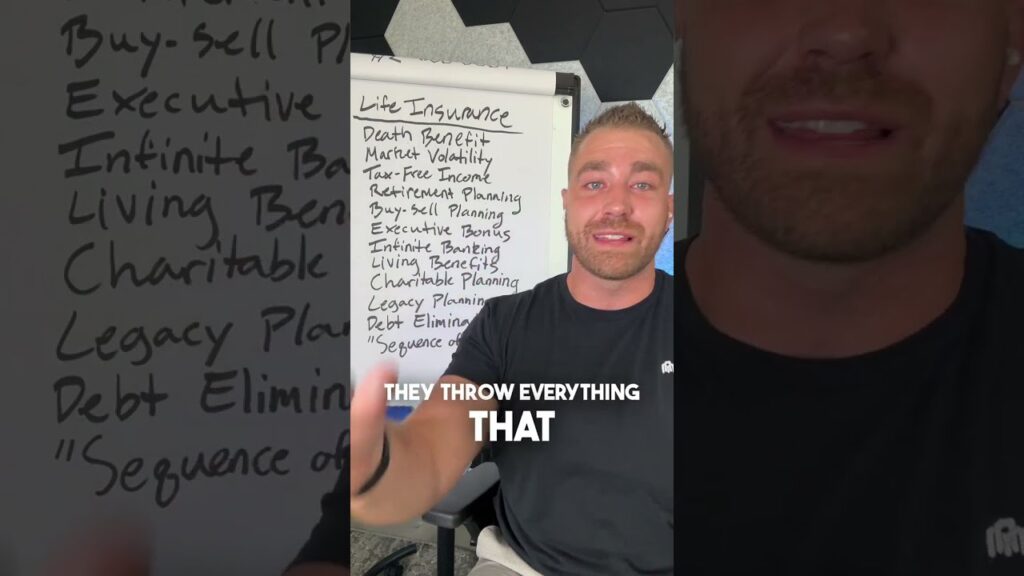

When it comes to life insurance marketing, the key to success lies in specialization. Instead of presenting a broad spectrum of benefits, which can often overwhelm or confuse potential clients, honing in on specific aspects of life insurance can significantly improve your conversion rates.

Here’s how to do it effectively:

- Identify Your Niche: Determine which part of life insurance you are most knowledgeable about and passionate about. It could be retirement planning, tax-free income, or estate planning. Specializing in a niche makes your message more relevant and compelling.

- Understand Your Audience: Know who you are targeting. Different demographics have varying concerns and needs when it comes to life insurance. Tailoring your message to address these specific needs makes your marketing more impactful.

- Craft Targeted Messages: Once you’ve identified your niche and understood your audience, create marketing messages that speak directly to them. Use language and examples that resonate with their specific situations.

- Educate Your Prospects: Often, people are unaware of the specific benefits of life insurance in areas like tax savings or retirement planning. Use your marketing platforms to educate them, helping them see life insurance as a solution to their specific problems.

- Use Real-Life Scenarios: Illustrate your points with real-life examples. This could be case studies, testimonials, or hypothetical scenarios that show how life insurance has helped or could help in situations similar to those your prospects are facing.

By focusing on specific aspects of life insurance, you not only make your marketing efforts more targeted but also position yourself as an expert in that area, which can significantly boost trust and credibility with your audience.

Creating the "Light Bulb Moment" in Prospects

The “Light Bulb Moment” is that pivotal instance when a prospect truly understands and appreciates the value of life insurance in their life. Achieving this moment in your marketing can dramatically increase conversion rates. Here’s how to create that crucial moment of realization:

- Address Common Misconceptions: Start by tackling the myths and misunderstandings about life insurance. Many people view it only as a death benefit, so educating them about living benefits can be eye-opening.

- Use Storytelling: Narratives are powerful. Share stories of how life insurance has made a significant difference in people’s lives, focusing on aspects that resonate with your target audience.

- Highlight the Emotional Value: Beyond the financial benefits, emphasize the peace of mind and security that life insurance provides to families. This emotional connection can be a strong motivator.

- Interactive Tools: Utilize calculators or interactive scenarios on your website that allow prospects to see the potential impact of life insurance on their own financial planning.

- Ask Provocative Questions: Pose questions that make prospects think about their current financial situation and future needs. Questions like, “How would your family manage financially if you weren’t around?” can trigger a reevaluation of their needs.

- Client Testimonials: Share testimonials from clients who had their own “light bulb moments.” Hearing from peers can be more convincing than any sales pitch.

By strategically guiding your prospects towards this moment of realization, you not only educate them but also build a deeper connection, making them more likely to consider life insurance as a vital part of their financial planning.

Effective Email Sequence Strategies

Email marketing remains a powerful tool in life insurance marketing, especially when it comes to nurturing leads and converting prospects. An effective email sequence can guide potential clients through the decision-making process. Here’s how to create an impactful email marketing strategy:

- Segment Your Audience: Tailor your emails based on where the prospect is in the buyer’s journey. Different messages should be sent to those who are just learning about life insurance compared to those who are considering a purchase.

- The Welcome Email: Start with a warm, informative welcome email. Introduce yourself, your services, and what they can expect from your emails. This sets the tone for future communications.

- Educational Content: Provide valuable information in your emails. This could include blog posts, articles, or videos that educate your audience about life insurance and its benefits.

- Personalization: Use the prospect’s name and reference any specific interactions or preferences they’ve shared. Personalization increases engagement and makes the recipient feel valued.

- Consistent Follow-Up: Don’t just send one email and forget. Have a sequence that gently nudges the prospect, reminding them of your services and how you can assist them.

- Call-to-Action (CTA): Each email should have a clear CTA, whether it’s to read a blog post, schedule a call, or request a quote. Make it easy for them to take the next step.

- Test and Optimize: Regularly review the performance of your emails. Look at open rates, click-through rates, and conversion rates. Use this data to refine your approach.

- Respectful Reminders: For those who showed interest but didn’t convert, send reminder emails that are respectful and not too pushy. Sometimes, timing can make all the difference.

Addressing Different Client Pain Points

Understanding and addressing the unique pain points of your clients is crucial in life insurance marketing. Each prospect comes with their own set of concerns and challenges. Here’s how to effectively address these pain points:

- Conduct Client Research: Start by understanding the common challenges and concerns your target audience faces. This can be done through surveys, feedback forms, or market research.

- Customize Solutions: Based on your research, tailor your life insurance solutions to meet these specific needs. For example, if a common concern is financial security for children, highlight how life insurance can provide for educational expenses.

- Educate on Misunderstood Aspects: Many clients have misconceptions about life insurance, such as cost or coverage limitations. Use your marketing materials to clarify these points and educate your audience.

- Address Financial Concerns: Discuss how life insurance can be a financial tool for retirement planning or estate management, not just a death benefit. This broadens the perceived value of life insurance.

- Use Case Studies and Examples: Share real-life examples where life insurance has helped individuals in similar situations to your prospects. This makes the benefits more tangible and relatable.

- Offer Flexible Options: Show that life insurance can be tailored to different budgets and needs. Offering flexibility can alleviate the concern that life insurance is too expensive or rigid.

- Provide Reassurance: Use testimonials and reviews to provide social proof. Knowing that others have successfully navigated these pain points can be reassuring to potential clients.

- Regular Communication: Keep the lines of communication open. Regular updates, informative content, and prompt responses to queries can help alleviate concerns and build trust.

By addressing these pain points directly and empathetically in your marketing efforts, you not only demonstrate your understanding of your clients’ needs but also position yourself as a knowledgeable and trustworthy advisor in the life insurance field.

Conclusion: Transform Your Marketing with Trained Advisor

In the competitive world of life insurance, effective marketing strategies are key to success. At Trained Advisor, we specialize in turning these strategies into powerful tools for business growth and client engagement. Here’s a snapshot of how we can elevate your marketing efforts:

- Expert Insights: Our team is always ahead of industry trends, ensuring your marketing is both innovative and effective.

- Strong Client Relationships: We focus on building trust and understanding, going beyond mere transactions.

- Advanced Technology: Utilizing the latest tools, we ensure your message reaches the right audience with precision.

- Data-Driven Strategies: Our approach is rooted in analytics, constantly refining your campaigns for optimal performance.

- Client-Centric Solutions: Your clients’ needs are our priority, guiding our tailored marketing strategies.

- Innovative Approaches: We embrace creativity in marketing, setting your campaigns apart from the competition.

Discover the impact of these strategies in our video, How to Get Your Life Insurance Marketing Campaign to Convert, and see how Trained Advisor can revolutionize your approach.

Visit us at trainedadvisor.com to start reshaping your life insurance marketing today.